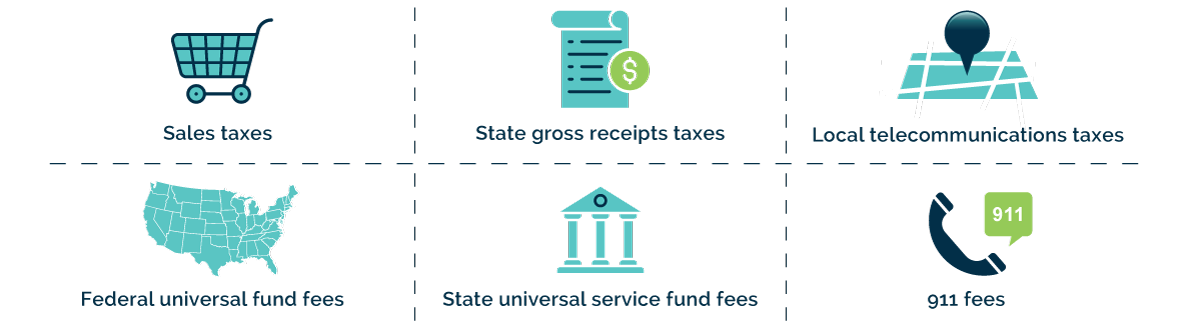

Communication companies, including VoIP providers and cable companies, must master the complex world of taxes and fees imposed on communication services, such as:

Billing and remitting these taxes and fees is a complex process. We understand that addressing communication tax and regulatory compliance can quickly drain your company’s resources and requires specialized knowledge and experience. Our team of tax compliance professionals can help you maintain compliance, maximize incentives, and address tax burdens from pre-launch through post-launch as well as ongoing growth and maintenance.

How We Help

P&N has extensive experience working with communications companies ranging from start-ups to large national carriers, including ISPs, wireline (LEC, CLEC, and IXCs), VoIP, and wireless and cable operators. Our team has helped with pre-launch services for carriers across the country, and we currently support dozens of carriers with licensing, registrations, tax strategy, and compliance. P&N provides comprehensive tax compliance support for carriers in a variety of stages.

Services

We offer a full range of services to the communications industry, including:

- Communications Tax and Fee Compliance

- Taxability of Services Determinations

- Due Diligence - Communications tax and fee compliance reviews

- Communications Tax Controversy and Audit Defense

- Registration Services

- Federal – FCC and USAC

- Secretary of State, including Registered Agent Services and Annual Reporting

- Public Service Commission

- Department of Revenue

- Local Taxing Jurisdictions

- Exposure Mitigation via Voluntary Disclosure Filings

- Refund Reviews – Purchases of services for resale and equipment purchases

- Procurement Solutions and Tax Planning

- Billing – Tax systems selection, integration, and implementation

- Exemption Certificate Management – Customer and vendor exemptions